In the world of mineral exploration and development, informed decision-making relies heavily on the quality and integrity of geological data. The JORC Code stands at the centre of this process in Australasia, underpinning market disclosures and project evaluations across the mining sector.

Whether you’re a capital investor, offtake buyer, financier, or regulatory authority, understanding why JORC matters is fundamental to evaluating a mining asset with confidence.

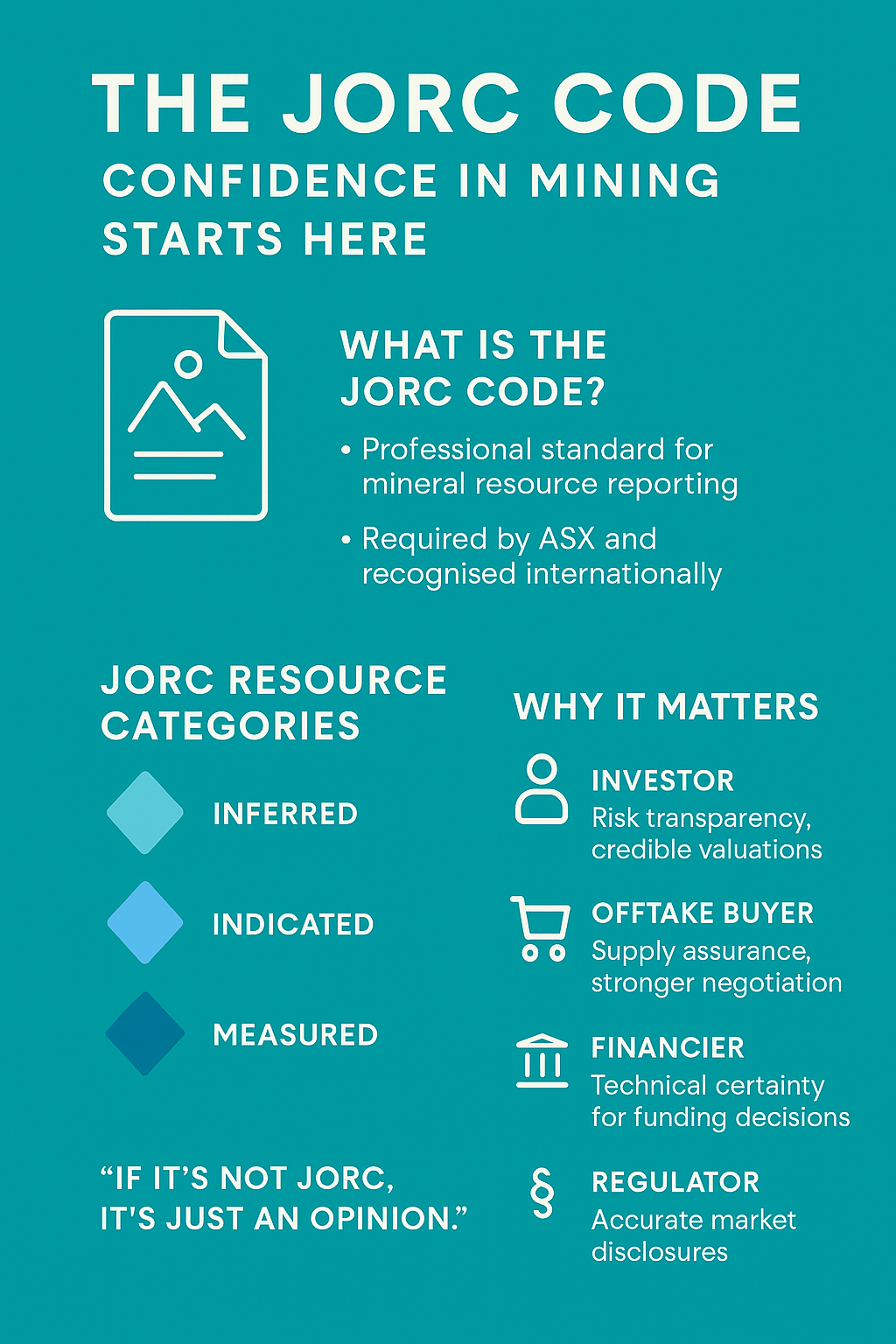

The JORC Code (Joint Ore Reserves Committee Code) is the mandatory reporting standard for exploration results, mineral resources, and ore reserves in Australia, New Zealand, and Papua New Guinea.

First established in 1989 and currently in its 2012 edition, the Code is recognised globally and aligned with the CRIRSCO international framework. It ensures that public disclosures are:

Material – relevant to the investment or operational decision at hand,

Transparent – clearly and unambiguously presented, and

Competent – prepared and signed off by an accredited Competent Person with at least five years of relevant experience.

A JORC Report documents and classifies mineral deposits according to specific confidence levels:

| Category | Description |

|---|---|

| Inferred | Based on limited data; low geological confidence |

| Indicated | Supported by sufficient sampling to allow preliminary planning |

| Measured | High-confidence data suitable for detailed engineering and mine design |

JORC Reports also incorporate technical, economic, and metallurgical assumptions, forming a foundation for feasibility studies, investment analysis, and mine planning.

For investors, particularly in listed junior and mid-tier resource companies, JORC-compliant reporting provides:

Credibility: Rigorous standards protect against promotional exaggeration.

Comparability: Clear classification enables consistent valuation across assets.

Transparency: Informs investment timing, scale, and risk appetite.

Valuation Input: Supports discounted cash flow models, resource-based pricing, and technical due diligence.

Without JORC compliance, investors are often left to rely on unverified or speculative data, exposing them to significantly higher risk.

Buyers seeking long-term supply contracts or exclusive marketing rights must evaluate the reliability of a project’s mineral base. JORC Reports provide:

Supply Confidence: Assurance that resource estimates are technically supported.

Contract Structuring: Guides delivery schedules, pricing models, and tonnage commitments.

Credibility with Funders: Buyers relying on trade finance or prepayment structures can present JORC Reports to underwriters or insurers as part of their risk analysis.

JORC-compliant reports are particularly critical when assessing small to mid-scale producers, where margins are tighter and delays or underperformance can quickly erode value.

Beyond investors and offtake partners, the JORC Code also serves:

Project financiers, who demand compliant reporting for credit risk assessments.

Regulators, who require it for continuous disclosure obligations (e.g. ASX listing rules).

Governments, for calculating resource royalties and national reserves.

Environmental and social consultants, who rely on JORC data for permitting and ESG planning.

Whether assessing a new exploration target or negotiating a supply contract, a JORC-compliant resource estimate is not just a technical formality, it’s a precondition for credibility in the mining industry.

At Bale Capital, we prioritise working with projects that maintain strict reporting standards and transparency, ensuring our partners, investors, buyers, and stakeholders, can make informed, secure, and timely decisions.

We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy.