USD-denominated bank accounts are central to cross-border trade and investment. This guide explains how account numbers, SWIFT/BIC, routing (ABA) numbers, and intermediary/correspondent banks work together to ensure accurate, compliant settlement.

1. The Basics of a USD-Denominated Account

A USD-denominated account is a bank account held in United States dollars. These accounts are common in international trade and offshore banking jurisdictions, allowing businesses to transact in the primary reserve currency while reducing FX exposure. When maintained outside the U.S., the account-holding bank typically relies on a correspondent banking relationship with a U.S. bank to clear and settle USD payments.

2. The Structure of Bank Account Details

A complete USD wire / TT instruction generally includes the following fields:

| Field | Description |

|---|---|

| Account Name | Legal name of the account holder (beneficiary). |

| Account Number / IBAN | Unique identifier for the beneficiary’s account. The U.S. does not use IBAN; many other countries do. |

| SWIFT / BIC Code | Bank Identifier Code used in the SWIFT network (e.g., CITIUS33). |

| Routing Number (ABA) | Nine-digit U.S. code used for ACH and Fedwire domestic routing. |

| Bank Name & Address | Official name and location of the beneficiary bank/branch. |

| Intermediary (Correspondent) Bank | U.S. bank that clears USD for the beneficiary bank located outside the U.S. |

| Reference / Payment Details | Free-text to identify purpose (e.g., invoice number, client code). |

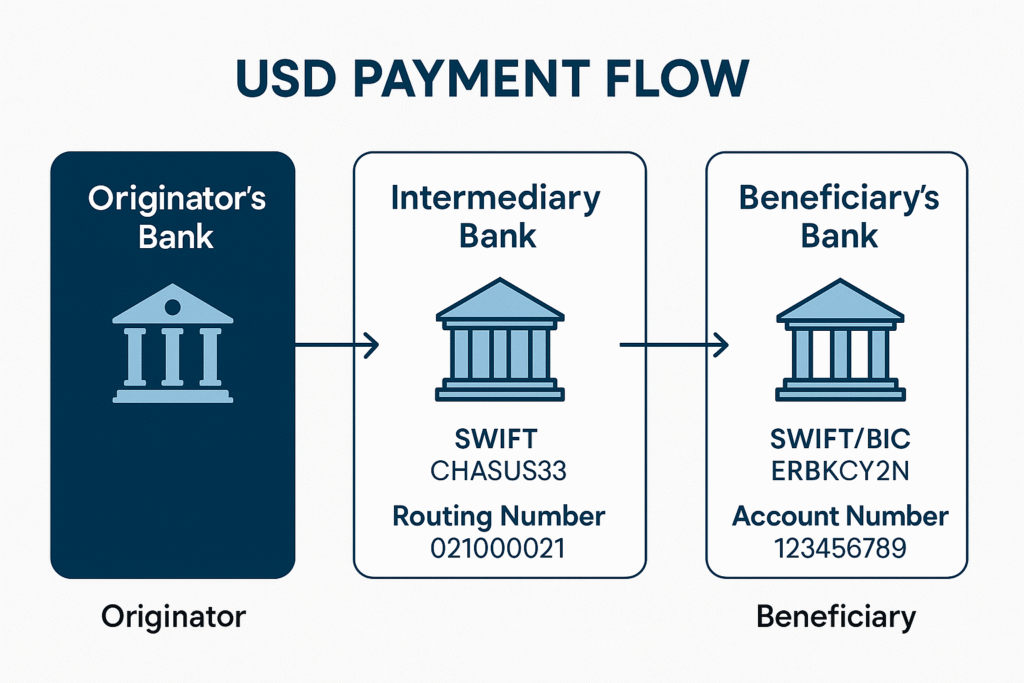

3. The Role of Intermediary Banks

- Originating bank sends the wire via SWIFT.

- The message identifies a U.S. intermediary bank that holds USD clearing accounts for the beneficiary bank.

- The intermediary credits/debits the correspondent account of the beneficiary bank.

- The beneficiary bank credits the recipient’s account.

This enables settlement through the U.S. Federal Reserve system even when the beneficiary bank is outside the U.S.

4. Routing Numbers, SWIFT/BIC, and CHIPS

- Routing Number (ABA): Domestic U.S. routing for ACH and Fedwire (e.g.,

021000021). - SWIFT/BIC: International bank identifier for SWIFT messages (e.g.,

CHASUS33). - CHIPS UID: Identifier used by the Clearing House Interbank Payments System for high-value USD wires.

In cross-border USD wires, instructions often include both the intermediary’s SWIFT and its routing (Fedwire/ABA) number.

5. Common Confusions Explained

- IBAN vs. U.S. account numbers: The U.S. does not use IBAN; other jurisdictions may require it.

- Intermediary vs. Beneficiary bank: The intermediary clears USD in the U.S.; the beneficiary bank maintains the customer’s account.

- Correspondent vs. Intermediary: Terms are commonly used interchangeably in USD clearing.

6. Example: USD Payment Instructions

Beneficiary Bank: Eurobank Cyprus Ltd, Nicosia, Cyprus

SWIFT: ERBKCY2N

Account Name: Dummy Entity LLC

Account Number: 123456789

Intermediary Bank: JPMorgan Chase Bank N.A., New York, USA

SWIFT: CHASUS33 | Routing (ABA): 021000021

Reference: Invoice No. 008-2025

The originating bank routes the wire / TT to the U.S. intermediary using its SWIFT and ABA numbers; the intermediary credits the beneficiary bank’s USD correspondent account, which then credits the customer.

7. Best Practices for Cross-Border USD Payments

- Verify intermediary/correspondent details with the beneficiary bank before sending.

- Do not truncate SWIFT or ABA numbers; one digit can delay settlement.

- Include a clear payment reference (invoice number, client code).

- Retain the MT103 SWIFT confirmation for reconciliation/audit.

- Match the remitter name to the account title to reduce AML holds.

8. Consequences of Omitting Routing or Correspondent Bank Details

Omitting or misstating routing bank or intermediary (correspondent) bank details can cause material disruption to USD settlement, which relies on the U.S. banking system and defined correspondent paths.

- Payment rejection/return: The U.S. clearing bank cannot identify the correct correspondent relationship and returns funds (often net of intermediary fees and FX costs).

- Extended delays: Manual routing or SWIFT queries (e.g., MT199/MT999) can extend settlement from 1–2 days to 10–15 business days.

- Heightened compliance review: Missing/mismatched data may trigger AML and OFAC reviews; funds can be held pending verification.

- Misapplied/partial credits: Incorrect details can lead to misposting, requiring SWIFT recalls (e.g., MT192/MT202COV) that may take weeks.

- Additional costs: Intermediaries may charge investigation and handling fees that reduce the final credited amount.

In short, incomplete intermediary or routing data can convert a routine wire into a complex cross-border recovery exercise with financial, operational, and reputational risk.

9. Alway Use the Correct Details

Each identifier in a USD wire/TT; account number, SWIFT/BIC, ABA routing, and intermediary bank serves a discrete function to move funds accurately and compliantly. Understanding and supplying complete details is essential to avoid delays, rejections, or costly investigations.

Disclaimer

The information contained in this article is provided for general informational purposes only and does not constitute financial, banking, or legal advice. While every effort has been made to ensure accuracy at the time of publication, banking procedures and regulatory requirements may vary between institutions and jurisdictions. Readers should verify details with their financial institution before initiating any cross-border transaction or relying on the information herein. The author and publisher accept no responsibility or liability for any loss or damage arising directly or indirectly from the use of, or reliance on, this material.