In the world of international banking and financial instruments, one persistent misconception continues to surface: “If a bank is connected to SWIFT, then it can receive messages from any other bank on the SWIFT network.”

This is false and believing otherwise can cause costly delays and failed transactions, especially when dealing with Standby Letters of Credit (SBLCs), Bank Guarantees, and other SWIFT-based financial instruments.

The SWIFT network (Society for Worldwide Interbank Financial Telecommunication) facilitates the secure exchange of financial messages between institutions globally. While access to the SWIFT network is a prerequisite, it is not sufficient on its own to send or receive authenticated financial messages between institutions.

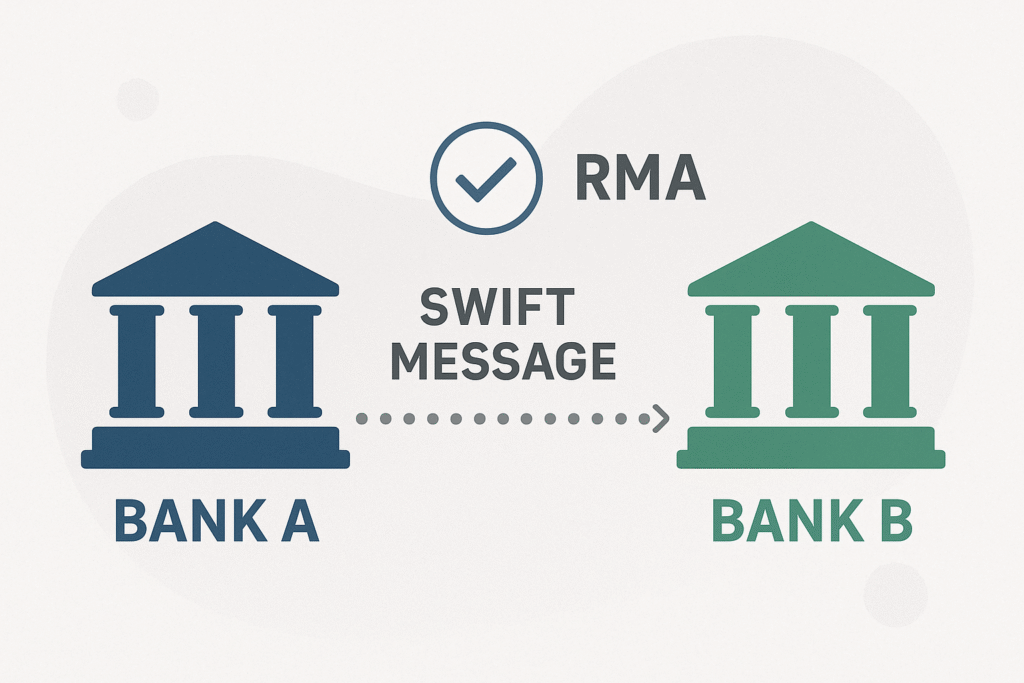

For a SWIFT message (such as an MT760 for an SBLC) to be transmitted and accepted between two banks, a Relationship Management Application (RMA) authorisation must be in place.

The RMA is a security protocol within SWIFT that controls which banks can send each other messages. It’s akin to a pre-approved contact list. Without an active RMA in place:

Bank A cannot send an authenticated message to Bank B.

Bank B’s system will automatically block or reject the incoming message.

This relationship must be mutually authorised. Just because Bank A is on the SWIFT network does not mean Bank B is obliged, or even able, to receive messages from it.

Consider the scenario where you intend to have an SBLC advised by your bank. You assume that since your bank is SWIFT-enabled, it can receive the SBLC directly from the issuing bank anywhere in the world.

However, your advising bank advises that:

“We maintain RMA only with HSBC UK. We cannot receive SWIFT messages from other banks.”

This means that unless the issuing bank is HSBC UK, or can route the SBLC through HSBC UK, your bank cannot receive the instrument. It’s not a matter of technical limitation, it’s a matter of policy and compliance.

Banks limit RMA arrangements for several reasons:

Risk Management: To avoid exposure to unverified or high-risk counterparties.

Compliance with AML/CFT laws: Especially important for banks operating in tightly regulated jurisdictions.

Operational Capacity: Some banks choose to work only with a few trusted institutions to reduce administrative burden.

Being connected to the SWIFT network does not automatically grant a bank the ability to receive messages from all other SWIFT users. An RMA relationship must be in place.

Therefore, when planning transactions involving SBLCs, BGs, or other financial instruments, it is essential to confirm in advance:

Whether the advising bank has an active RMA with the issuing bank, or

Whether a routing arrangement (e.g. via HSBC UK) can be used.

Ignoring this detail can result in failed transmissions, rejected instruments, and ultimately, broken deals.

We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy.