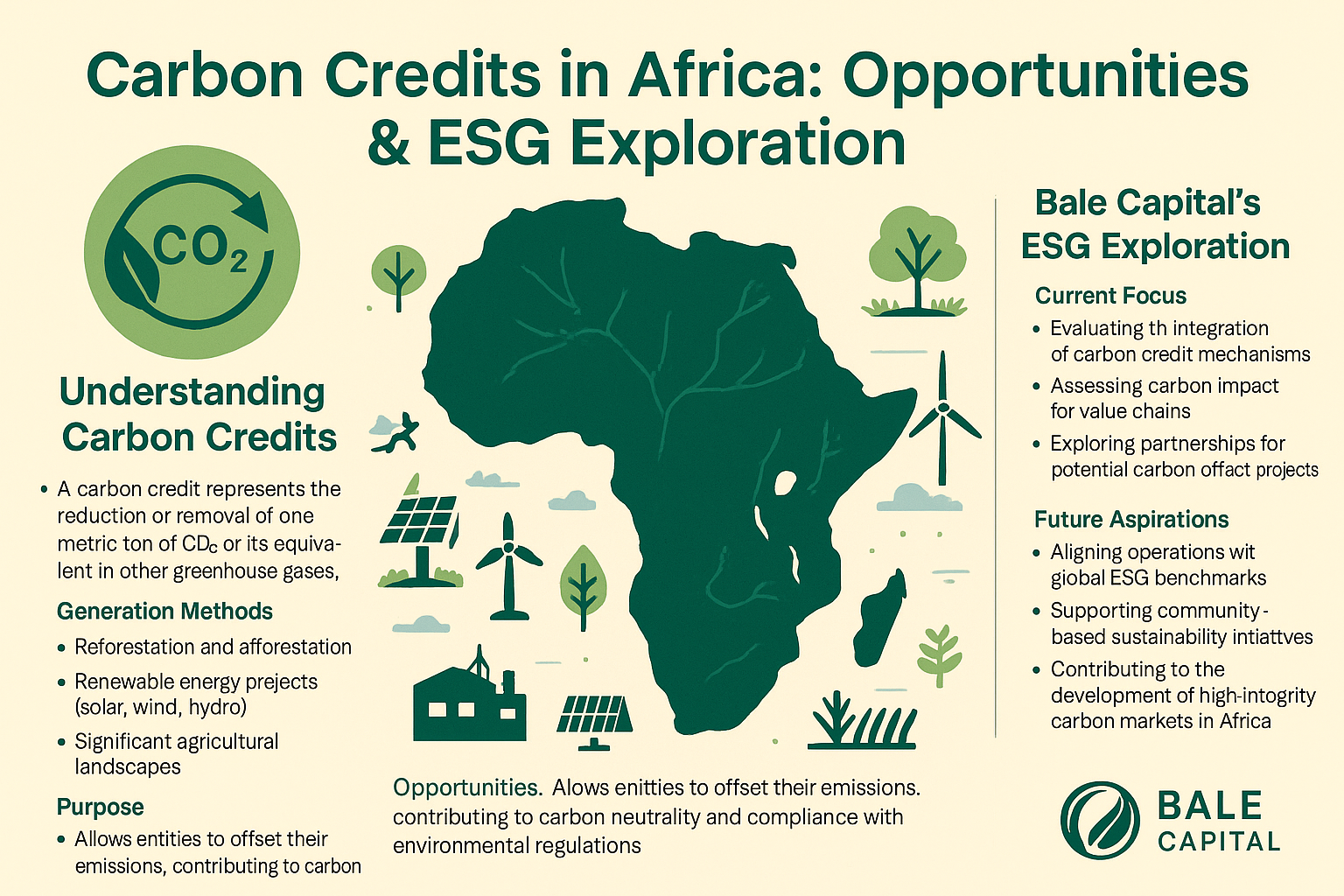

As global industries intensify their efforts to meet climate objectives and uphold Environmental, Social, and Governance (ESG) standards, carbon credits have emerged as a key financial and environmental mechanism. For Africa, a continent endowed with rich ecological assets and untapped climate potential, the carbon credit market presents a compelling opportunity to attract investment and drive sustainable development. Within this evolving context, Bale Capital is actively exploring how its operations might align with carbon markets and ESG principles to support responsible and forward-thinking business practices.

A carbon credit is a tradable instrument that represents the reduction or removal of one metric tonne of carbon dioxide (or its equivalent in other greenhouse gases) from the atmosphere. These credits are typically generated through:

Renewable energy projects (solar, wind, biogas)

Reforestation and afforestation

Conservation and avoidance of deforestation

Regenerative agriculture and land-use practices

Industrial and methane capture technologies

Such credits may be sold into voluntary or regulated compliance markets, enabling entities to offset their carbon emissions as part of their environmental mitigation strategies.

Africa is uniquely positioned to contribute meaningfully to the global carbon credit supply due to:

Vast tracts of forests, wetlands, and grasslands capable of significant carbon sequestration

Rapidly expanding renewable energy infrastructure

A growing interest in sustainable land management and climate resilience

Opportunities under international mechanisms such as Article 6 of the Paris Agreement

Despite its potential, Africa has historically received only a modest share of global climate finance and carbon credit issuance. Closing this gap could support both economic development and environmental stewardship.

As part of its broader ESG exploration strategy, Bale Capital is evaluating the feasibility of integrating carbon credit-related mechanisms into its operational framework. The company remains committed to identifying ways to:

Support community-based sustainability initiatives, particularly in regions affected by resource extraction or infrastructure development.

Understand the carbon impact of its value chains and how emissions may be mitigated or offset through credible mechanisms.

Explore partnerships with project developers and technical experts to assess carbon credit viability across sectors such as mining rehabilitation, reforestation, and renewable energy deployment.

Align future operations with global ESG benchmarks, including transparency, accountability, and social equity.

While Bale Capital is not currently involved in the structuring or financing of carbon credit projects, it recognises the increasing relevance of such instruments and is proactively considering how future engagement may support long-term environmental and commercial goals.

As part of its ongoing ESG due diligence, Bale Capital is reviewing global best practices for:

Project verification and certification through accredited standards (e.g., Verra, Gold Standard)

Community engagement protocols, particularly around land rights and benefit sharing

Climate risk disclosures in alignment with investor expectations and regulatory developments

Carbon market dynamics that may affect pricing, access, and reputational integrity

This approach ensures that any future participation in carbon-related activities would be grounded in a strong governance framework and aligned with the company’s core values.

Carbon credits represent one of the many tools through which Africa can monetise its environmental capital while supporting the global low-carbon transition. For Bale Capital, the exploration of carbon markets is a natural extension of its strategic interest in responsible resource management and sustainable development.

As the regulatory and financial landscapes surrounding climate finance evolve, Bale Capital remains committed to assessing how its operations can adapt and contribute to a more sustainable and climate-conscious future.

We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy.