In international resource and commodity trading, contractual performance and payment certainty are critical.

Parties rely on bank issued instruments to reduce counterparty risk, manage exposure across borders, and ensure timely performance.

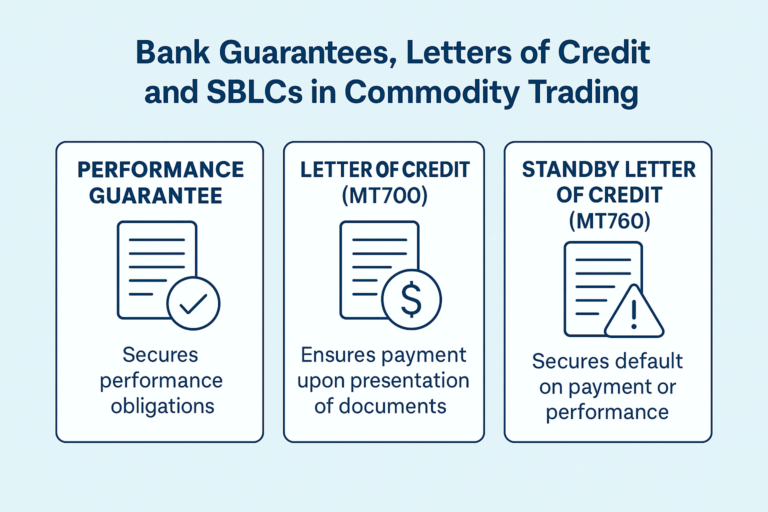

Three instruments dominate this landscape:

Although sometimes used interchangeably in practice, each carries a distinct legal structure, commercial function, and risk profile.

This article examines their differences, overlaps, and, crucially, how a Buyer-issued Performance Guarantee can function as a payment security equivalent to an SBLC, a nuance particularly relevant in commodity and resource supply contracts.

A Bank Performance Guarantee is an irrevocable, independent undertaking issued by a bank on behalf of an applicant,

ensuring that the beneficiary will be compensated if the applicant fails to perform the underlying contract. These guarantees are governed by the ICC Uniform Rules for Demand Guarantees (URDG 758), which emphasise the autonomy of the instrument

and payment against compliant demand.

Traditionally, performance guarantees secure the seller’s performance obligations, such as delivery volumes, timing, quality, or contract milestones. If the seller under-delivers or fails to meet obligations, the buyer may call the guarantee and receive compensation from the bank, subject to the terms of the guarantee and the requirements for a compliant demand.

In commodity trading, commercial practice often diverges from strict textbook definitions. It is common for the buyer (not the seller) to issue a Bank Performance Guarantee in favour of the seller.

In this structure, the guarantee provides the seller with assurance that the buyer will perform its payment obligations. The wording of the guarantee is drafted so that a non-payment event constitutes a valid trigger for drawing on the guarantee. This effectively transforms the Performance Guarantee into a payment security instrument.

Yes. When drafted to secure payment, a Buyer-issued Performance Guarantee becomes commercially and functionally similar to a Standby Letter of Credit (MT760), because:

The key distinctions then become:

In operational and commercial effect, however, the outcome is the same: the seller is secured against buyer default on payment obligations.

This nuance is critical in large-scale commodity transactions where sellers demand strong security before committing to shipments, especially where payment occurs post-inspection, post-assay, or on deferred terms.

A Letter of Credit (LC) is a primary payment instrument governed by ICC UCP 600. The issuing bank irrevocably undertakes to pay the seller upon presentation of documents that comply strictly with the credit terms. The SWIFT MT700 format is used to issue the LC.

The MT700 LC is the most widely used payment mechanism across metals, minerals, petroleum products, fertilisers, and agricultural commodities. Sellers benefit from bank-backed certainty of payment; buyers preserve cash flow by leveraging bank credit lines rather than paying entirely in advance.

A Standby Letter of Credit (SBLC) operates as a secondary, default-based payment obligation. It is similar in purpose to a guarantee, although governed by different rule sets (typically ISP98 or UCP 600). It is transmitted via SWIFT MT760.

Where a performance guarantee is drafted to secure the buyer’s payment obligations to the seller, the legal and commercial effect becomes very similar to that of an SBLC. The differences relate mainly to:

In practice, both instruments serve to enhance the seller’s security in high-value cross-border commodity transactions.

All three instruments operate independently of the underlying commercial contract. The bank deals in documents and demands, not in factual disputes or contract interpretations between buyer and seller.

| Feature | Performance Guarantee (URDG 758) | Performance Guarantee Issued by Buyer (Payment Guarantee) | Letter of Credit MT700 (UCP 600) | SBLC MT760 (ISP98/UCP 600) |

|---|---|---|---|---|

| Primary Purpose | Secure seller’s performance obligations in favour of the buyer | Secure buyer’s payment obligations in favour of the seller | Primary payment instrument for shipped/delivered goods | Backstop securing payment or other contractual obligations |

| Nature | Secondary, default-based obligation | Secondary, default-based obligation (payment-focused) | Primary, direct payment obligation | Secondary, default-based obligation |

| Trigger for Payment | Beneficiary’s demand alleging breach of performance | Beneficiary’s demand alleging non-payment by the buyer | Presentation of strictly compliant documents | Beneficiary’s demand alleging non-payment or non-performance |

| Who Is Protected? | Buyer | Seller | Seller | Seller (or sometimes a financier) |

| Funding Type | Contingent liability on the bank | Contingent liability on the bank | Primary payment by the issuing/confirming bank | Contingent liability on the bank |

| Bank Pays When | Applicant fails to perform and a complying demand is presented | Buyer fails to pay and a complying demand is presented | Seller presents documents that comply with LC terms | Buyer fails to pay or perform and a complying demand is presented |

| Commodity Trading Use | Delivery and performance assurance in favour of the buyer | Payment assurance to the seller where buyer credit risk is a concern | Shipment-based payment in international trade | Security for deferred payment terms, prepayment structures, and structured trade finance |

| Functional Equivalent To | Traditional demand guarantee | Functionally equivalent to an SBLC | N/A | Payment or performance guarantee |

In commodity and resource trading, the choice between a Bank Performance Guarantee, an MT700 Letter of Credit, and an MT760 SBLC depends on the risk allocation and commercial structure of the transaction.

A critical nuance is that when a Buyer issues a Performance Guarantee that secures payment obligations, the instrument becomes functionally equivalent to an SBLC, despite being governed by URDG 758 rather than ISP98 or UCP 600. In this structure, the seller receives robust protection against buyer default, enabling confidence in rolling deliveries, deferred payment terms, and high-value resource supply contracts.

By carefully selecting and structuring these instruments, parties can align risk mitigation with operational realities across borders, jurisdictions, and volatile markets, thereby supporting stable and predictable international resource and commodity trade flows.

This document is provided for general informational purposes only and does not constitute financial, legal, or professional advice. While care has been taken to ensure accuracy, no warranty is given as to the completeness or reliability of the information contained herein. Readers should seek independent advice before acting upon any information provided.

We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy.