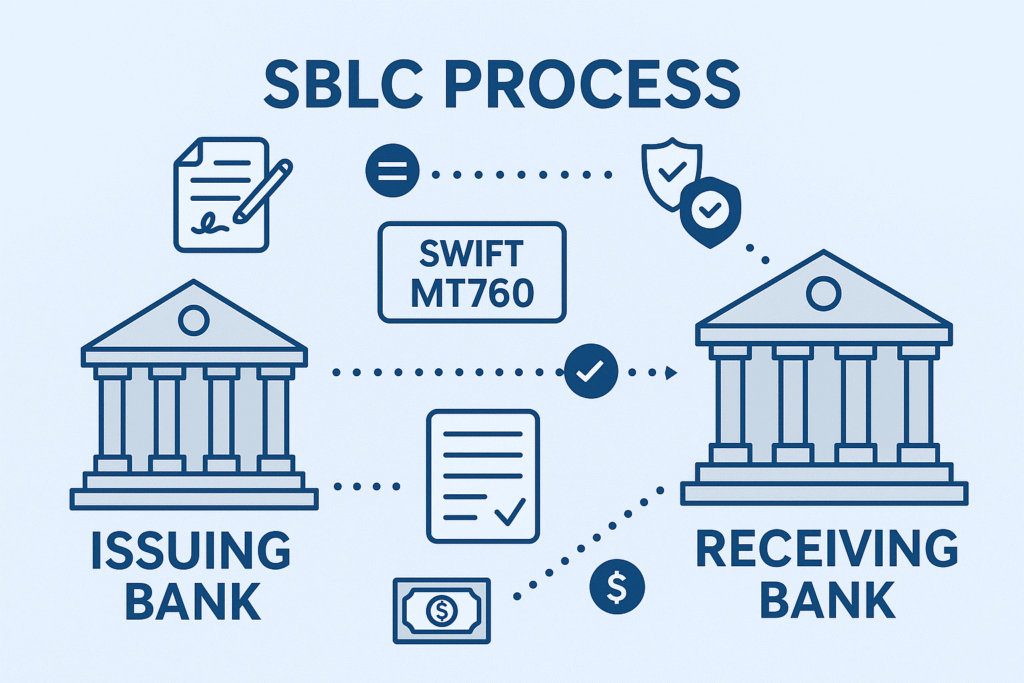

In international trade and structured finance, the Standby Letter of Credit (SBLC) is a pivotal instrument offering assurance of payment to beneficiaries. It serves as a credit enhancement mechanism where the issuing bank guarantees payment on behalf of the applicant (buyer) if the applicant fails to fulfil their contractual obligations. This article outlines the structured and sequential process—specifically between the issuing and receiving banks—that underpins the issuance of an SBLC, including a detailed explanation of the SWIFT messaging involved.

The buyer and seller enter into a formal contract that stipulates the use of a Standby Letter of Credit as the payment security mechanism.

The contract outlines key terms such as the SBLC amount, tenor, issuing and receiving bank details, acceptable format, and conditions of drawdown.

The buyer submits a formal SBLC application to their bank (the issuing bank), enclosing the signed contract and the beneficiary’s bank coordinates.

The buyer’s bank will conduct compliance checks, credit assessment, and verify internal limits before proceeding.

The issuing bank prepares a draft of the SBLC in accordance with the contract terms and sends it to the buyer and, where applicable, the beneficiary for review and approval.

The draft includes key elements such as:

Beneficiary name and address

SBLC amount and currency

Expiry date and place

Drawdown conditions

Confirmation of irrevocability

Governing rules (e.g., ISP98 or UCP600)

Once the SBLC draft is approved, the issuing bank typically sends a SWIFT MT799 to the receiving bank (beneficiary’s bank).

Purpose: The MT799 acts as a pre-advice message, confirming the intention to issue a specific SBLC. It includes preliminary details such as:

Confirmation of intent to issue a specific SBLC

Details of the issuing bank

Statement that the SBLC will be irrevocable, unconditional, and cash-backed

Confirmation that funds are available or reserved

The receiving bank may reply with an MT799 or MT999 acknowledging the receipt and confirming readiness to receive the formal instrument.

In some cases, the receiving bank may request changes to the format, wording, or issuing terms, especially if it acts as advising or confirming bank.

Upon successful completion of due diligence and mutual confirmation, the issuing bank transmits the actual Standby Letter of Credit to the beneficiary’s bank using a SWIFT MT760.

MT760 Message Contents typically include:

SBLC Reference Number

Issuer and Beneficiary Bank details

Full legal name of applicant (buyer) and beneficiary (seller)

Amount and currency

Effective and expiry dates

Detailed terms and drawdown conditions

Governing rules and applicable law

The receiving bank reviews the MT760 and confirms receipt to the beneficiary.

The bank may also issue an MT799 or internal notification to advise the beneficiary that the SBLC has been received and is now operative.

Where required, the beneficiary may request that the SBLC be confirmed by a reputable bank, especially if the issuing bank is in a high-risk or unfamiliar jurisdiction.

The confirming bank adds its own undertaking of payment and typically confirms via SWIFT MT799 or internal messaging systems.

If the buyer fails to perform as per the contract, the beneficiary may draw on the SBLC by presenting documents as required (e.g., a demand for payment or performance certificate).

The receiving bank forwards the demand to the issuing bank, typically using SWIFT MT799 or MT999 with attached PDF evidence.

Upon validation, the issuing bank honours the payment obligation and transfers funds accordingly.

If no draw is made, the SBLC expires on the stated date.

The issuing bank may send an MT799 or MT759 (Advice of Non-Utilisation or Cancellation) to formally close the instrument.

| Message Type | Purpose |

|---|---|

| MT799 | Free-format pre-advice or communication between banks |

| MT760 | Issuance of the Standby Letter of Credit |

| MT999 | General free-format message for informal updates |

| MT759 | Advice of Non-Utilisation or Cancellation |

| MT199 / MT299 | Low-priority variations of MT799 or MT999 |

The issuance and handling of an SBLC between the issuing and receiving banks is a coordinated, multi-step process governed by international standards, compliance protocols, and SWIFT messaging infrastructure. A well-structured SBLC arrangement ensures payment certainty for the seller and transactional security for all parties involved. Whether the SBLC is used for trade finance, project support, or performance guarantees, understanding the detailed mechanics and message flows between the banks is essential for successful execution.

If you are seeking banking partners experienced in SBLC issuance or discounting, or require assistance in structuring your transaction, feel free to Contact

our team for tailored support.

We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy.