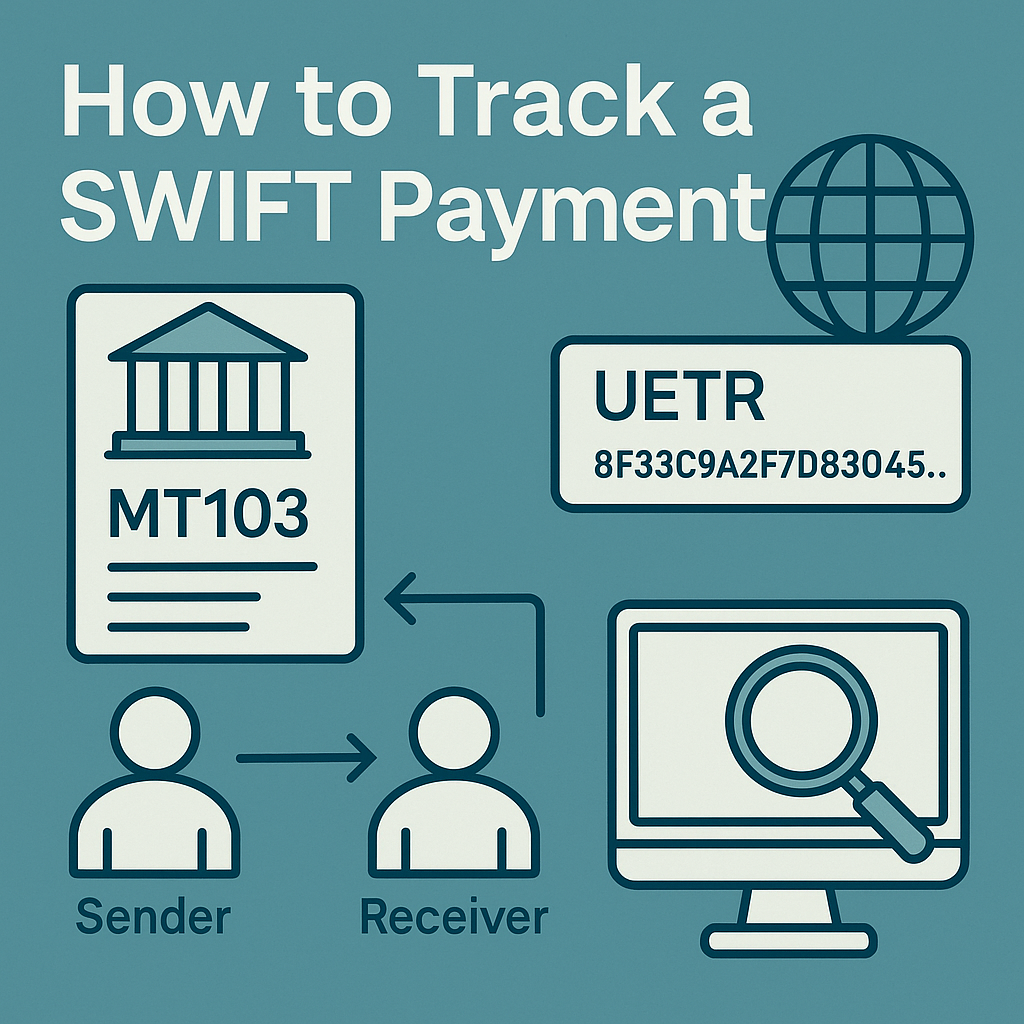

An MT103 is the formal SWIFT message type used for a single customer credit transfer. It serves as the payment’s DNA record, showing the sender, receiver, intermediaries, amount, currency, and value date.

It includes critical fields such as:

The MT103 is legally accepted evidence of transmission and is typically required to open an investigation or satisfy a commercial obligation that payment was made.

The UETR (Unique End-to-End Transaction Reference) is a 36-character identifier attached to every SWIFT payment. It functions like a courier tracking number, enabling all banks in the chain to see the transaction’s current status through the SWIFT gpi Tracker.

Statuses visible through UETR include:

Having the UETR allows your bank (and sometimes you) to retrieve real-time updates: whether the payment is received, credited, on hold, or returned.

Beyond the MT103 and UETR, several other professional tools and mechanisms assist in tracing payments:

When a transaction involves USD, extra complexity arises because almost all USD clearing is performed via US-based correspondent banks.

Before any transfer, verify that account identifiers are structurally correct and correspond to the right financial institution.

| Type | Tool / Official Registry | Link |

|---|---|---|

| IBAN | SWIFT IBAN Registry | swift.com/iban-registry |

| IBAN | SWIFTRef IBAN Validation | swift.com/iban-validation |

| BIC/SWIFT Code | SWIFT Free BIC Search | swift.com/bsl-free |

| U.S. Routing Number | Federal Reserve E-Payments Directory | frbservices.org/EPaymentsDirectory |

| Australia BSB | AusPayNet BSB Search | auspaynet.com.au/resources/bsb |

| General Validator | IBAN.com (Non-official but widely used) | iban.com/iban-checker |

| Code | Description | Meaning |

|---|---|---|

| ACSP | Accepted for execution | Payment is processing normally |

| PDNG | Pending | Awaiting compliance clearance |

| RJCT | Rejected | Payment returned or failed |

| ACSC | Accepted – Settlement Completed | Beneficiary bank credited |

| CANC | Cancelled | Payment recalled or stopped |

The MT103 is strong evidence of payment dispatch but not proof of credit; rely on the UETR final confirmation for proof of receipt. Contracts should define “payment received” as the time at which the beneficiary’s bank confirms credit, not merely when funds leave the sender’s bank.

For regulated industries or high-value trades, keep a full audit trail: MT103, UETR log, and bank correspondence confirming receipt. Be alert to false proofs of payment (forged MT103s); always verify authenticity through your bank using the UETR or a call-back confirmation.

This document is provided for general informational purposes only and does not constitute financial, legal, or professional advice. While care has been taken to ensure accuracy, no warranty is given as to the completeness or reliability of the information contained herein. Readers should seek independent advice before acting upon any information provided.

We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy.